FAME: Connecting The Dots in European Embedded Finance

Lauresha Toska, Ladan Raeisian & Nelia Zinatullina from eco Association explain how the EU-funded FAME project is building Europe’s trusted digital infrastructure for embedded finance – a secure, regulation-ready marketplace for financial data that ensures trust, compliance, and sovereignty.

©Natee127 | istockphoto.com

Embedded Finance (EmFi) is fast becoming a hallmark of the digital economy. From one-click checkout in an online store to insuring a car rental or accessing a loan directly at the point of purchase, consumers increasingly interact with financial services without ever dealing with a traditional bank. This seamless integration offers convenience, but it also exposes a critical infrastructure gap. Today’s centralized systems struggle to balance innovation with the complex web of European financial regulations, data sovereignty requirements, and privacy protections.

Traditional financial infrastructure wasn’t designed for this distributed, embedded world. Banks and FinTechs often find themselves locked into proprietary platforms, duplicating data across systems, and struggling to maintain compliance across multiple jurisdictions. Meanwhile, valuable data remains siloed, preventing cross-sector collaboration that could drive true innovation.

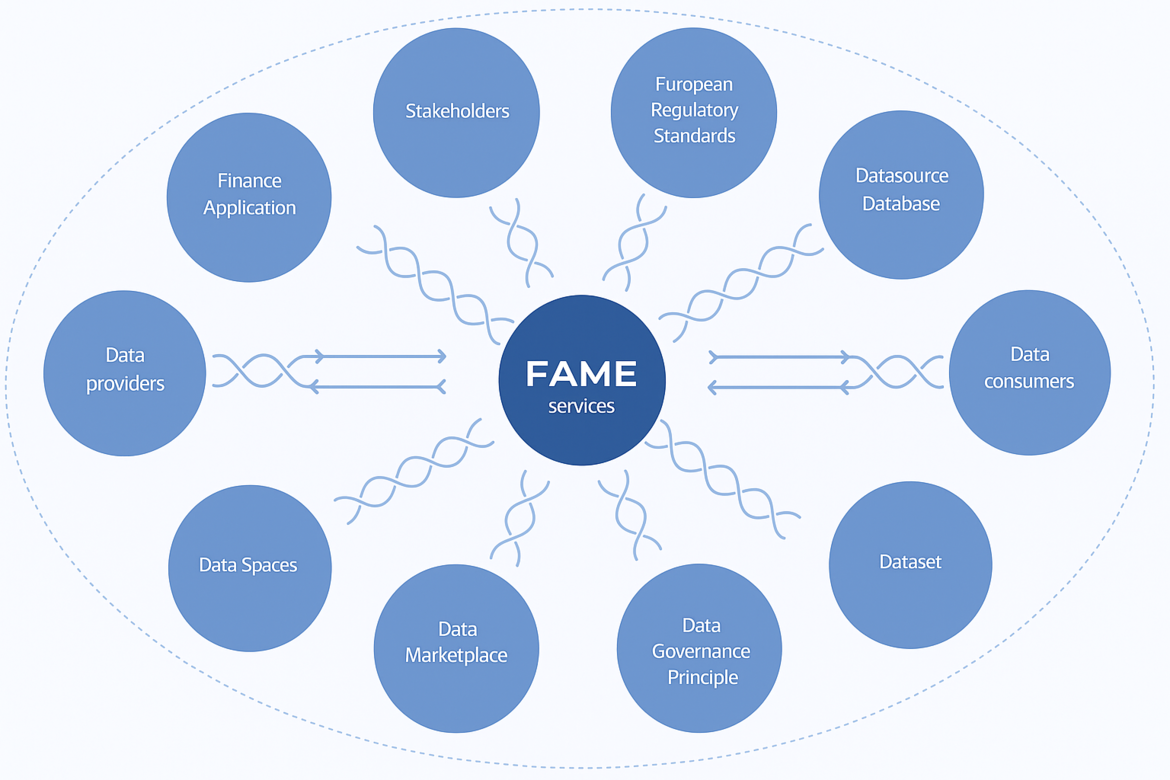

That's where the FAME project steps in. FAME – short for Federated, decentralized, trusted dAta Marketplace for Embedded finance – tackles these challenges by establishing a secure infrastructure for data sharing aligned with European values and legal frameworks. Instead of centralizing control, FAME adopts a federated model that distributes data governance while maintaining high standards of interoperability, security, and compliance. This lays the foundation for Embedded Finance to grow within a secure, sovereign European data space.

FAME in a Nutshell

Federation as a security model

FAME transforms security from a constraint into an enabler. With the help of blockchain, data remains in its original location, eliminating risks associated with large-scale transfers and centralized storage.

Organizations maintain sovereignty over their assets while participating in a trusted ecosystem that facilitates secure collaboration across borders.

FAME achieves this through semantic interoperability standards like the extended Data Catalog Vocabulary (DCAT) and financial sector-specific ontologies such as FIBO/FIGI, ensuring data can be exchanged securely across platforms without semantic discrepancies.

The paradigm shift is profound: from “trust through central authority” to “trust through verification.” Each participant in the federation maintains their security standards while adhering to common protocols that ensure seamless, secure interaction.

Identity and access: The foundation of trust

Self-Sovereign Identity (SSI) serves as the foundation for FAME’s approach to identity and access management, enabling individuals and organizations to manage digital credentials independently. This means using the same digital ID across multiple services without relying on intermediaries like Google or Facebook.

FAME’s Authentication and Authorization Infrastructure (AAI) adapts access policies dynamically based on context – jurisdiction, risk level, time of access, and intended use. For example, a fraud detection model might have different permissions during market hours versus overnight processing.

The Assets Policy Manager acts as the guardian of asset security, implementing Rule-Based Access Control (RBAC) that combines user and organizational attributes. As the Policy Decision Point, it ensures that only authenticated and authorized entities can access assets, creating nuanced policy rules that adapt to complex scenarios.

This dynamic approach addresses the “identity crisis” in traditional federated systems, where trust management and privacy preservation often conflict with usability and consistent access rights.

Compliance by design, not by accident

Rather than treating compliance as overhead, FAME embeds regulatory requirements as core security features. The platform natively supports GDPR, PSD2, MiFID II, the Fourth Anti-Money Laundering Directive, and the EU’s AI Act through dynamic policy management.

FAME’s AML-as-a-Service model exemplifies this approach, transforming compliance from manual burden into automated advantage. Smart contracts enforce policies automatically while maintaining comprehensive audit trails, enabling smaller institutions to compete with larger players without building complex regulatory infrastructure in-house.

The platform’s Explainable AI (XAI) and Situation Aware Explainability (SAX) technologies ensure that automated decisions can be audited and explained to regulators, meeting growing requirements for algorithmic transparency in financial services.

This transforms the European regulatory landscape from a competitive disadvantage into a differentiator. Organizations using FAME gain compliance capabilities that become selling points rather than cost centers.

Blockchain for integrity, not storage

FAME employs blockchain strategically, focusing on transactional integrity without typical scalability issues. Smart contracts enforce business rules and record data provenance, while asset tokenization through Non-Fungible Tokens enables secure, traceable ownership of data assets. The platform’s internal stablecoin facilitates automated transactions within the trusted ecosystem.

Crucially, FAME avoids storing sensitive data on-chain. Instead, blockchain is used for what it does best: creating verifiable processes, automated policy enforcement, and tamper-proof audit trails.

Security in practice: Real-world scenarios

Consider a FinTech building credit risk models across multiple European markets using federated learning. Customer data never leaves each country’s jurisdiction, yet the resulting models benefit from patterns across the entire EU market. The models learn from the patterns in the data without ever seeing individual records, dramatically improving accuracy while maintaining strict GDPR compliance.

Similarly, insurance companies can embed micro-coverage into mobility apps across multiple countries, with claims models running in real-time through FAME’s federated infrastructure. Smart contracts automatically adapt to local regulations while maintaining consistent security standards.

These scenarios demonstrate how compliance and innovation reinforce each other when trust and governance are built into infrastructure from the ground up.

The European security advantage

As an EU-funded initiative, FAME proves that European values and technological excellence can coexist and create competitive advantages. The platform integrates seamlessly with Gaia-X and the European Data Spaces strategy, providing infrastructure that demonstrates how stringent data protection can accelerate rather than hinder digital innovation.

Looking ahead, FAME’s dynamic security policies will optimize AI/ML services while minimizing energy consumption through Energy Efficient Analytics with CO2 monitoring. Rate limiting adjusts to fluctuating energy prices and client priorities, demonstrating how European values of environmental responsibility integrate with cutting-edge security technology.

By embedding trust directly into technical infrastructure, FAME creates conditions where financial innovation flourishes precisely because underlying systems are reliable and transparent. Europe is proving that the most secure and trustworthy systems are often the most innovative ones.

This article is based on insights from the following white papers:

1- FAME: A Federated Secured, Trusted and Interoperable Marketplace and Data Space

2- FAME: Federated Decentralized Trusted Data Marketplace for Embedded Finance

📚 Citation:

Toska, Lauresha, Raeisian, Ladan, & Zinatullina, Nelia. (October 2025). FAME: Connecting the Dots in European Embedded Finance. dotmagazine. Retrieved October 2025, from https://www.dotmagazine.online/issues/security-trust-compliance/fame-eu-funded-project

Lauresha Toska is Senior Manager for Innovation & Digital Ecosystems at eco – Association of the Internet Industry. As Technical Lead of FACIS (IPCEI-CIS) and Project Lead of Eclipse XFSC, she leads strategic efforts to advance Europe’s digital resilience through federated infrastructures, self-sovereign identity (SSI), and secure, interoperable cloud-edge ecosystems. With a background in IT engineering and digital business, she bridges technology and policy to strengthen digital sovereignty and shape resilient, future-proof ecosystems across Europe.

Ladan Raeisian is a Junior Project Manager for eco International Communications and part of the dotmagazine editorial team at eco – Association of the Internet Industry.

FAQ

What problem is the FAME project solving in embedded finance?

The FAME project addresses the gap between embedded financial services and existing infrastructure by creating a federated, regulation‑ready data marketplace. It enables secure data sharing, interoperability, and sovereignty aligned with European values and the eco – Association of the Internet Industry framework. :contentReference[oaicite:2]{index=2}

How does the federated marketplace model work and why is it important?

Rather than centralising data, FAME uses a federated model where data stays with providers and is accessed under common standards. This ensures data sovereignty, reduces transfer risk, and supports cross‑border business in Embedded Finance. :contentReference[oaicite:3]{index=3}

What key technologies power the FAME infrastructure?

The infrastructure relies on:

• Self‑Sovereign Identity (SSI) and dynamic access policies for identity and access management.

• Semantic interoperability using standards like DCAT and financial ontologies for meaningful data exchange.

• Blockchain tokenisation and smart contracts for value‑based data trading and verifiable audit trails. :contentReference[oaicite:4]{index=4}

How does FAME embed compliance and trust “by design”?

Regulatory frameworks—such as GDPR, PSD2, MiFID II and the AI Act—are built into the platform via rule‑based policy management and explainable AI (XAI) tools. This shifts compliance from being a cost centre to a business differentiator. :contentReference[oaicite:5]{index=5}

What practical use‑cases show FAME in action?

Real‑world use‑cases include:

• An insurer embedding climate‑prediction analytics in mobility apps across borders.

• A FinTech sharing training data sets without moving raw personal data, thanks to the federated model.

These examples demonstrate how financial services can evolve securely under FAME. :contentReference[oaicite:6]{index=6}

What strategic advantage does Europe gain from FAME?

Europe turns its strong regulatory and privacy standards into a competitive edge by using sovereign digital infrastructure for Embedded Finance. FAME is aligned with initiatives like Gaia‑X and the European Data Spaces strategy to accelerate innovation without sacrificing trust. :contentReference[oaicite:8]{index=8}

What should firms and institutions do now to engage with Embedded Finance under FAME?

Organizations should:

• Map where financial data is used and shared.

• Understand federated models and sovereignty requirements.

• Explore pilot participation in FAME’s ecosystem.

Preparing early enables organizations to leverage trust‑based infrastructure rather than retrofit it later.